The Ultimate Guide To Offshore Business Formation

Table of ContentsOffshore Business Formation Can Be Fun For AnyoneThe smart Trick of Offshore Business Formation That Nobody is Talking AboutOffshore Business Formation - Questions5 Easy Facts About Offshore Business Formation ExplainedFascination About Offshore Business FormationOur Offshore Business Formation IdeasRumored Buzz on Offshore Business FormationOur Offshore Business Formation StatementsWhat Does Offshore Business Formation Do?

If you signed up a business in Hong Kong, its income would just be strained from 8. The earnings that is made outside of Hong Kong can be entirely excused from local tax. Apple, Samsung, Google, Berkshire Hathaway, they all have actually established overseas firms as their subsidiaries in numerous countries all over the world.

Offshore Business Formation - Truths

Some countries enforce unbelievably high tax prices on company revenue. 5% in Puerto Rico, 30% in Germany, and also 25% in France That's why thousands of business owners out there have actually made a decision to go offshore.

Tax obligation optimization does not necessarily imply to avert taxes. When seeking tax remedies, you must conform with both the laws in the incorporated territory as well as your home country.

Excitement About Offshore Business Formation

They are starting to enforce taxes and also laws on certain kinds of revenue as well as business activities. And also some areas have a truly bad online reputation in the organization world.

Specifically, financial institutions in Singapore or Hong Kong are very worried regarding opening up a make up firms in tax havens. The same selects clients and customers. They would likewise be concerned to do organization with your company if it is included in such territories. The pressure certainly is on picking the right location.

Top Guidelines Of Offshore Business Formation

That's why comprehensive planning and research is a need to (or a minimum of the appropriate assessment from the genuine specialists). Instance Here is an example for offshore preparation: You open a business in the British Virgin Islands (BVI) to supply solutions overseas. You also establish your company's monitoring in an additional nation to make it not a BVI-resident for tax purposes.

And also because BVI has a reasonable credibility, you can open a business checking account in Singapore. This will certainly enable your business to obtain money from consumers easily. If needed, you then need to develop your tax obligation residency in an additional nation where you can obtain your company money without being tired.

Some Known Facts About Offshore Business Formation.

These countries usually have a network of global tax obligation treaties, which can bring you tax reduction as well as also exemption. If you accept paying a small amount of tax in return for respect and also stability, low-tax jurisdictions can be the ideal choice.

This implies, your properties are shielded versus the judgment made by international courts. Just the court of the incorporation jurisdiction can place a judgment on the possessions. For circumstances, if you formed a rely on Belize, the trust fund's residential or commercial property would be secured from any claim according to the law of one more jurisdiction.

The Only Guide for Offshore Business Formation

Some other usual offshore facilities that use economic privacy are the BVI, Seychelles, Cayman Islands, as well as Nevis. The overseas consolidation procedure is instead basic and also fast.

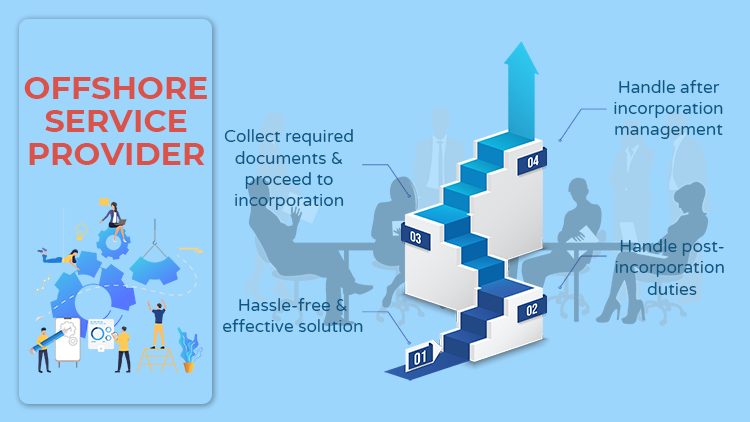

The incorporation needs are usually really marginal. The very best thing is that lots of company around can help you with the enrollment. All you need to do is find a credible supplier, spend for solution, and also supply essential files. They will go on and also sign up the business on your behalf.

Little Known Questions About Offshore Business Formation.

: Situated in the western Caribbean Sea, this is an extremely usual selection for a lot of foreign financiers that are looking for tax-free benefits.: BVI and Cayman Islands recommended you read share lots of common attributes - offshore business formation. But a plus is that the incorporation expense in the BVI has a tendency to be far more cost effective than that in the Cayman Islands.

There are bunches of various kinds of company entities. When choosing your type of entity, you ought to consider the adhering to facets: The entity legal standing The responsibility of the entity The tax and various other advantages of go the entity Tip, The advice is to go for the kind of company that has a separate lawful condition.

Offshore Business Formation Fundamentals Explained

A different legal entity warranties you a high level of security. That said, there are still instances where you might find that a partnership or various other special structures are much more helpful. And also everything relies on your specific situation. Each jurisdiction has a different collection of demands as well as consolidation process.

Not known Details About Offshore Business Formation

The reason is that immigrants do not have details devices and accounts to sign up on their own. Even when it is not important source obligatory, you are still recommended to utilize an unification service.